Annual Report 2023

Our 2023 Annual Report presents our strategy, our forms of operation and our performance in 2023.

Through the report, we explain how we generate value in the short, medium and long term, and the impact of our actions on society. To this end, we follow the integrated report model of the Value Reporting Foundation and the sustainability standard of the Global Reporting Initiative (GRI), in addition to meeting the accountability requirements of the Federal Court of Accounts (TCU).

The 2023 edition of the Annual Report was approved by the Executive Board on May 16, 2024 and by the Board of Directors on May 24, 2024.

The BNDES has once again become a fundamental agent for the economic, social, and environmental development of our country, committed to rebuilding the present and to future-oriented agendas with the purpose of improving the lives of generations.

The Bank has resumed a more active role in supporting and driving some of the Federal Government’s main policies, such as New Growth Acceleration Program (Novo PAC), New Industry Brazil (Nova Indústria Brasil), and the Ecological Transformation Plan. The promotion of a more resilient infrastructure, a more innovative neoindustrialization, and a more inclusive socio-environmental defense have been significant marks of this new period.

To this end, it is essential to preserve the traditional sources of funding of BNDES, such as FAT, but it is also necessary to seek alternative sources of income, such as resources from public funds, international funding, and the possibility of issuing incentive-based fixed-income market instruments such as Development Credit Notes (LCD).

The commitment to a new industrialization of the Brazilian economy as a sector that generates greater added value, more innovation, and more technology is one of the highlights of the BNDES strategy. It is necessary to work in harmony with a modern industrial policy that enables green, creative, inclusive, innovative, and digital solutions and that generates opportunities for Brazilian companies globally.

At a time when the climate crisis is worsening, the climate change mitigation and adaptation agenda is fundamental. The BNDES seeks not only to minimize the impacts of its activities and of the investments it finances, but also to be an agent of change in the restoration of biomes, the preservation of biodiversity, climate adaptation, and the promotion of more sustainable business practices that reduce emissions, always considering a just transition that involves job and income generation and respect for diversity.

Managed by the BNDES, the Amazon Fund had its governance reestablished in 2023, resumed the analysis of proposals, launched two public calls, and received new donations. The Climate Fund had its funding increased, with more than BRL 10 billion expected for 2024, the largest volume of resources in the history of the fund since its creation in 2009.

In infrastructure, the green, energy, and ecological transition stands out. According to Bloomberg, the BNDES is the bank that has most financed clean and renewable energy in history worldwide. The use of renewable energy sources and the pursuit of new technological routes are part of its strategy as is providing the population with access to quality services and reducing inequalities.

In the agricultural sector, the BNDES promotes the production of biofuels and food, supporting low-carbon and precision farming techniques and encouraging social and productive inclusion through family farming. Monitoring signs of deforestation in rural properties subject to credit operations by using the MapBiomas tool enables a more accurate verification of the territorial impacts of operations, suspending the release of funds for those considered irregular.

Regarding support for micro-, small-, and medium-sized enterprises (MSME), the BNDES seeks to expand access to credit and reduce bank concentration, having significantly increased partnerships with cooperative banks and credit cooperatives in recent years. The Bank has differentiated conditions for this audience and works through guarantees to facilitate credit access for this segment.

Companies play an important transformative role in society and, if imbued with a public vision of the common good, they can contribute to a fairer and less unequal Brazil. We have been working in partnership and in complement with the private sector to develop the country.

Due to its very nature, the BNDES cannot only financially but also socially and environmentally support a positive change in the Brazilian reality. To achieve this, it is necessary to start from within, having a strong and inclusive culture that values diversity in all its aspects and promotes transparency in all dimensions.

The transparency efforts of the Bank have been recognized by regulatory bodies. A survey conducted by the Association of Members of the Brazilian Courts of Accounts (ATRICON) found that BNDES public portals are the most transparent among the analyzed Brazilian state-owned enterprises. Additionally, the Bank achieved first place in the Brazilian Office of the Comptroller General (CGU) ranking that evaluates the degree of active transparency of public agencies.

This report, whose integrity of information we ensure, is an important instrument of transparency and accountability. It provides a broad overview of the BNDES’s operations in 2023 and its strategy for the coming years. It represents, therefore, a commitment to what is expected for the future: an institution that combines a higher volume of operations with the effectiveness of its activities, always attentive to relevant issues for the Brazilian economy and society.

Board of Directors

BNDES | BNDESPAR | FINAME

The year 2023 marks the beginning of the reconstruction of the BNDES as a public bank focused on the economic, social, and environmental growth and development of the country.

The results are unequivocal when compared to 2022: consultations grew 88%, totaling BRL 270.8 billion; approvals increased by 44%, reaching BRL 218.5 billion; and disbursements expanded by 17%, reaching BRL 114.4 billion, equivalent to 1.1% of the Brazilian gross domestic product (GDP). It is worth highlighting that more than 80% of disbursements were made without subsidies at market rates.

The domestic environment of improving macroeconomic growth indicators and positive expectations in 2023 increased the demand for the Bank’s support. The return to its historical vocation enabled us to offer more credit to boost the economic performance of the country.

Net profit increased to BRL 21.9 billion and default rates remain the lowest in history, at 0.01%. The BNDES Basel Index closed the year at 31.5%, well above the 10.5% required by the Central Bank of Brazil (BCB). The expanded credit portfolio reached BRL 515 billion, the highest value in the last five years.

The BNDES once again provided support for the new investment cycle: the Investment Guarantee Fund (FGI) ensured a total of BRL 44 billion, more than double that of 2022. The Bank also contributed to alleviating the adverse conditions the capital market experienced, having subscribed to 26% of the incentive-based debenture issuances in 2023.

Credit approvals increased across all sectors, with emphasis on infrastructure, at BRL 78.5 billion (23% growth); agriculture, at BRL 42.5 billion (53% increase); and industry, at BRL 31.7 billion (up 41%).

This expansion occurs with companies of different sizes: operations with micro-, small-, and medium-sized enterprises (MSME) reached BRL 107 billion, up 53% when compared to 2022. Operations to support cooperatives reached BRL 23.8 billion, an increase of 63% in comparison to 2022. Diversification in client profiles contributes both to job creation and to reducing the concentration of the credit market in Brazil.

The BNDES was once again present throughout the country, strengthening the federative pact and territorial and regional development.

We financed BRL 25.3 billion for states and municipalities. Through the Telecommunications Services Universalization Fund (FUST), in 2023, we started a connectivity program that will bring broadband to public schools, favelas, and rural areas.

The Bank also intensified its international presence through external funding that totaled USD 3.2 billion contracted in 2023 (approximately BRL 15.5 billion) in partnerships with the Inter-American Development Bank (IDB), the China Development Bank (CDB), the International Fund for Agricultural Development (IFAD), the New Development Bank (NDB), and the German Development Bank (KfW).

On all these fronts, the BNDES acted not only as a credit provider but also as an instrument of support and formulation of central public policies for the current government. This occurred during the construction of the New Growth Acceleration Program (PAC), the New Industry Brazil (Nova Indústria Brasil), the Ecological Transformation Plan, and the expansion of the Harvest Plan (Plano Safra). The Bank also created new instruments to promote agriculture, to combat deforestation, and to promote sustainability.

This all led to the BNDES reaffirming its role and its commitment to Brazilian neo-industrialization, the reconstitution of the of the infrastructure of the country, and a green economy oriented toward ecological transformation, energy transition, and sustainable development.

There were BRL 5.3 billion in approvals for innovation and BRL 13.5 billion for exports, in addition to the resumption of the Amazon Fund, with approvals and launched calls reaching a record BRL 1.3 billion.

We reformulated the new Climate Fund, in partnership with the Ministry of Finance. The ministry guaranteed funding of BRL 10.4 billion, with more appropriate interest rates to face and mitigate climate emergencies and promote sustainable urbanization, green industry, resilient logistics infrastructure, energy transition, and forest protection.

We took the first step in building the Amazon Restoration Arch, an initiative that brings together countries, companies, and governments to restore the largest tropical forest in the world. The initial stage aims to restore 6 million hectares by 2030, starting off with BRL 1 billion in investments from the BNDES. Through programs such as Floresta Viva, Sertão Vivo, and BNDES Corais, we reaffirm our commitment to preserving the various Brazilian biomes.

In 2023, the BNDES Strategic Affairs Commission was created. Reviving its historical tradition of promoting national debate, the Bank organized, in partnership with governmental and non-governmental institutions, large-scale seminars. The discussions focused on topics such as sustainable environmental development and energy transition; Black empowerment; neo-industrialization; healthcare; defense and national security; the relationship between law and development; and impacts of artificial intelligence in Brazil. The events featured renowned speakers, including Joseph Stiglitz, winner of the Nobel Prize, state ministers, authorities from government and international organizations, CEOs of domestic companies, representatives of civil society, academic researchers, jurists, and military personnel.

In 2023, the BNDES was recognized as the most transparent federal public institution in the country in research conducted out by the Association of Members of the Brazilian Courts of Accounts. In the ranking prepared by the Brazilian Office of the Comptroller General (CGU), it was listed as one of the public development institutions with the greatest variety of methods to monitor and evaluate the effectiveness of its own actions in the world.

The result of collective work and learning, this report presents the main results achieved by the Bank in 2023 and highlights how we are reformulating our strategy for the coming years, seeking to generate value for Brazilian society in the short, medium, and long term. The publication follows the principles of integrated reporting, as required for reporting to the Federal Court of Accounts (TCU), and seeks to present the main economic, social, and environmental impacts of the BNDES based on the Global Reporting Initiative (GRI) model.

We, therefore, ensure the integrity of this report and invite readers to learn more about our vision on the following pages.

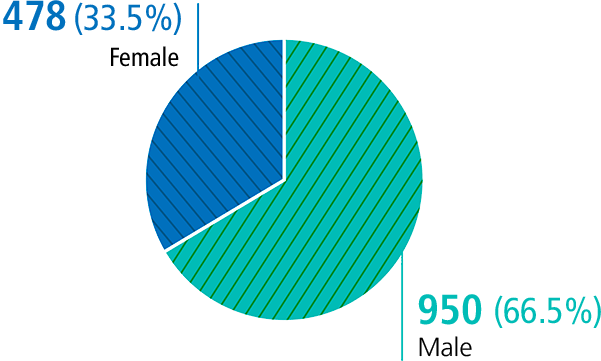

After eleven years without renewing and expanding its staff, the BNDES will soon hold a new public examination, incorporating future-bearing careers related to data science and cyber security and, to promote inclusion and diversity, the Bank will reserve 30% of these vacancies for Black candidates and at least 10% for people with disabilities (PWD).

The BNDES is committed to promoting a plural work environment. In this sense, we carry out initiatives to combat racism, promote gender equality, and value diversity.

The results of this 2023 Annual Report reaffirm our purpose of building a green, inclusive, transparent, industrializing, technological, digital, and innovative BNDES. It is a Bank capable of serving partners of all sizes in all sectors and in all regions of the country; a Bank committed to rebuilding the present and transforming the future of Brazil.

Aloizio Mercadante

President of the BNDES

We are the Brazilian Development Bank (BNDES), a federal public company linked to the Ministry of Development, Industry, Trade and Services (MDIC), being the primary instrument of the Federal Government, our sole shareholder, for long-term financing and investment in various segments of the Brazilian economy. We have been operating since 1952 and are one of the largest development banks in the world.

The BNDES System comprises three companies: the BNDES and its subsidiaries—BNDES Participações S.A. (BNDESPAR), which operates in the capital market, and the Agência Especial de Financiamento Industrial S.A. (FINAME), dedicated to promoting the production and commercialization of machinery and equipment.

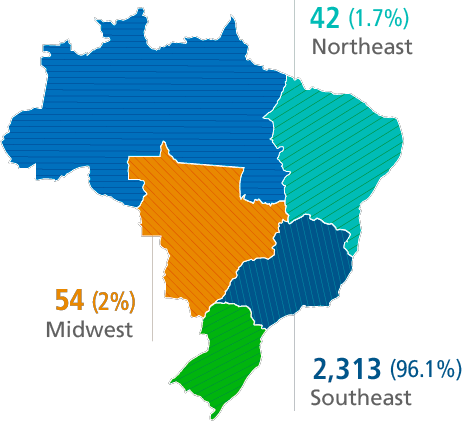

We operate across the national territory. We have four operational units: our headquarters in Brasília (DF); our office in Rio de Janeiro, located in the Juvenal Osório Gomes Service Building (Edserj), in which more than 94% of our employees work; and two representations in São Paulo (SP) and Recife (PE).

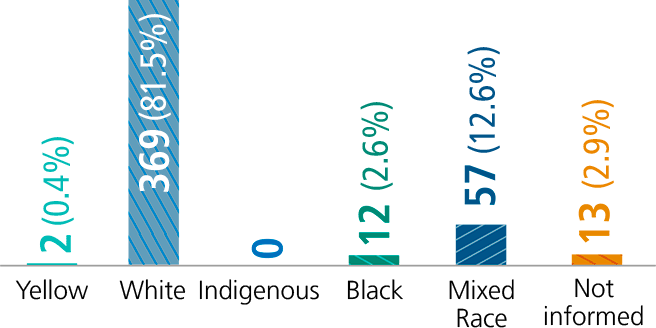

Our team has 2,430 employees committed to promoting sustainable development and to excellence—2,409 hired through a public examination, 14 hired on a temporary basis for commissioned positions linked to senior management, and seven transferred from Federal agencies for the same purpose. Moreover, there are nine directors and the president.

Our long-term strategy, approved by the Board of Directors, is made up of the institutional identity, strategic themes, guidelines and objectives, as well as our business models. It also includes an analysis of risks and opportunities for the coming years and the annual business plan, which establishes strategic indicators and targets for the year.

In 2023, after a change in administration, we revised our long-term strategy and the 2023 Business Plan, which was approved by the Board of Directors in May. Another structured review was conducted throughout the year and, in December, the Board approved the BNDES System’s Long-Term Corporate Strategy for the next five years (2024-2028 Strategy).

The current strategy presents 21 strategic themes: seven sectoral business themes, seven transversal business themes and seven business support themes), including their respective keywords.

Material topics are those that affect our ability to generate value in the short, medium and long term and that cause a relevant economic, social or environmental impact.

A materiality review was carried out for this report considering the directions of the Bank’s senior management, the new 2024-2028 Strategy, and active listening to the business and business support areas and our stakeholders.

At the end of the process, we defined five material themes approved by the Executive Board and the Board of Directors.

Our support to the sector aims to promote the sustainability and competitiveness of biofuel and food production, encouraging and supporting the dissemination of techniques such as low-carbon and precision farming. Our financial solutions are available to producers and companies of all sizes, from family farmers to large cooperatives and agribusiness companies.

We are one of the main channels for the Federal Government’s Agricultural Programs (PAGF) under the Harvest Plans. In 2023, we approved BRL 30.4 billion in credit operations using these programs’ resources. Cooperative banks and credit cooperative systems played a significant role in this performance, facilitating the provision of about 50% of the total resources.

In terms of social and productive inclusion focused on family farming, we work with non-refundable resources to encourage the transition to healthy and sustainable food systems, contributing to climate change adaptation, increased productivity, stabilized family income, improved food security, and maintaining youth activity in rural areas. In 2023, these investments totaled BRL 101.4 million, with 50% from the BNDES through the Bank’s Socioenvironmental Fund.

Our support for MSMEs is strategically guided to expand credit access, encourage cooperativism, and expand operations in microcredit, as well as to offer financial and non-financial solutions dedicated to the segment, including through capital market, with a focus on increasing the number of MSMEs supported.

We act as an important instrument of the Federal Government in implementing public policies for the segment, with the aim of expanding MSMEs’ access to credit and guarantees through direct and indirect financial instruments—the latter being the main form of support for these companies.

Whenever possible, we incorporate the needs of this audience through differentiated financial conditions or tailored instruments.

We support the sustainable operation of MSMEs, focusing on a just ecological transition and on social solutions, contributing to increased productivity, innovation, and value generation, for these companies throughout their production chain, including export capacity.

Through our support, we contribute to increasing MSMEs’ productivity and positively impact variables that indicate the growth of these companies, such as investment, employment, and revenue. Besides the effects on the supported companies, positive results are observed for the local economy.

Our strategic guideline for environmental issues is to promote a just transition to a carbon-neutral, resilient, and climate adapted economy. Our contribution to the decarbonization of the Brazilian economy includes to encourage projects in the following areas:

Investments in infrastructure have a great influence on economic growth, productivity, job creation, and income and on improving the quality of life of Brazilians. We seek to reduce the investment gap in infrastructure, promoting resilience and climate adaptation, energy transition, and expanding access to quality services, reducing inequalities.

In this sense, we structure and finance projects to support:

One of our strategic guidelines is to promote a new industrialization of the Brazilian economy, making it greener and more innovative, inclusive, and digital and expanding the complexity of the industrial sector to enable the production of goods and services with greater added value.

To achieve this, we have been working with the Federal Government, in its construction of a modern industrial policy, with a mission-based approach, as defined by the National Council for Industrial Development (CNDI).

We seek to structure and finance projects to promote:

In 2023, we launched three calls for proposals for ecological restoration projects under the Floresta Viva initiative. The first, in partnership with Eneva, covers projects for conservation units in the Amazon; the second, in partnership with Energisa, Fundo Vale, and Norte Energia, allocates resources to the Xingu River basin; and the third, in partnership with Petrobras, is aimed at Biodiversity Corridors in the Cerrado and Pantanal. Together, the calls total BRL 77.5 million in restoration projects.

João Felipe Bassanezi is a partner at BSW, a company operating in the earthmoving and construction sector, located in the municipality of Dois Vizinhos (PR). As a member of the Cresol financial institution, he obtained resources from the Procapcred Program to acquire new capital quotas in the cooperative. The operation contributed to the capitalization of the credit cooperative and, at the same time, increased the cooperative microentrepreneur’s potential to attract credit for investment in his business.

In 2023 we reformulated the Cisterns program, in partnership with the Banco do Brasil Foundation (FBB) and the Ministry of Social Development and Fight Against Hunger (MDS). The program now focus on promoting food security and income generation by supporting the implementation of cisterns for food production for personal consumption and sale of surplus at fairs and local markets, along with family support services. This reformulation aims to benefit 1,400 low-income rural families in 17 municipalities of the Brazilian semi-arid region. The investments total BRL 40 million, of which 50% are from the BNDES.

In 2023, there are 3 operations within the scope of the BNDES Mais Inovação program worth highlighting: the credit approved for Embraer, WEG Equipamentos Elétricos, and Volkswagen do Brasil, which totaled BRL 1.1 billion. We approved financing of BRL 500 million for the Embraer innovation investment plan, which foresees a total investment of BRL 650 million from 2023 to 2027. For WEG, we approved BRL 119 million in credit to support the development of more efficient, sustainable, and digital products and processes. As for Volkswagen, we approved BRL 500 million to support the company’s R&D plan in technologies.

We approved BRL 702.8 million in financing for the municipality of Rio de Janeiro (RJ) to support the implementation of the Urban Mobility Plan for the neighborhood of Campo Grande. The project foresees a set of interventions to modernize the neighborhood’s road system, with new connections and improvements at junctions, new cycle paths, and sidewalk upgrades. The project will improve the roads where the Transoeste BRT and the Transbrasil BRT feeder buses pass, as well as the safety of cyclists and pedestrians.

During 2023, we approved the Quebradeiras de Coco Babaçu project in partnership with the Vale Foundation, which aims to support the socioproductive inclusion of 450 family units of babaçu coconut breakers and the strengthening of the Maranhão Women’s Network, which brings together around 15 communitybased social businesses, with investments totaling BRL 6.4 million, half of which came from the BNDES.

Our governance structure aims to strengthen our management, favoring a transparent and collective decision-making process. This structure encompasses the Executive Board, the Board of Directors (BoD), the Fiscal Council (Cofis), the Audit Committee (Coaud), the Risk Committee (CRI), the People, Eligibility, Succession, and Remuneration Committee (COPE), and the Social, Environmental, and Climate Responsibility Committee (CRSAC), among other committees of directors and superintendents responsible for supervising and monitoring the actions of the BNDES System administrators.

In addition to these bodies, the BNDES’s bylaws include, among its internal governance units, the Internal Audit, the Integrity and Compliance Division (AIC), and the Ombudsperson’s Office. The Internal Affairs unit is linked to AIC, a division led by a statutory director responsible for risk management and internal controls.

Fiscal council (Cofis): supervises the acts of the administrators and verifies the fulfillment of their legal and statutory duties; analyzes the quarterly financial statements of the BNDES; examines and issues an opinion on the semiannual financial statements of the institution, among other attributions.

COMPOSITION OF THE FISCAL COUNCIL AS OF 12.31.2023:

Board of Directors (BoD): this is our highest level of governance. The Board provides its opinion on relevant issues of the country’s economic and social development related to our actions; advises the President of the Bank on general guidelines for its actions; approves general policies and long-term action programs; expresses its opinion on the institution’s financial statements, and approves the corporate strategy and annual business plan, among other duties. The President of the Board of Directors holds no other executive position at the Bank.

COMPOSITION OF THE BOARD OF DIRECTORS ON 12.31.2022:

Risk Committee (CRI): proposes recommendations to the Board of Directors on policies, strategies and limits of risk and capital management, stress test program, business continuity management policy, contingency plan for liquidity and capital; assesses risk appetite levels; analyzes the BNDES risk environment, among other attributions.

Audit Committee (Coaud): decides on the hiring and dismissal of the independent auditor; reviews, prior to publication, the half-yearly financial statements; evaluates the effectiveness and supervises the activities of the independent auditors and the internal audit; monitors the quality and integrity of the internal control mechanisms, the financial statements and the information disclosed by the BNDES; evaluates and monitors risk exposures of the Bank.

Social, Environmental and Climate Responsibility Committee (CRSAC): a non-statutory body that aims to advise the Boards of Directors of the companies that are part of the BNDES System in the performance of their duties related to monitoring the BNDES System’s Social, Environmental and Climate Responsibility Policy (PRSAC) and all actions related to it, in conformity with the provisions established by the regulations of the National Monetary Council.

People, Eligibility, Succession and Remuneration Committee (COPE): this is the body that provides opinions and advice to the controlling shareholder and the Board of Directors in the processes of nomination, evaluation, succession and remuneration of administrators, fiscal advisors and other members of statutory bodies.

Collegiate of Project Structuring Directors: among other duties, approves the performance management model of the portfolio of projects under structuring; acts as the final instance of evaluation of the structuring of projects in which the BNDES has a legal mandate to execute and monitor privatization; and acts as the final instance of evaluation of the of projects in which the BNDES has contracted responsibility for modeling advice.

Information Technology Executive Committee: deliberates on the IT Strategic Plan and the IT Master Plan and their revisions, as well as monitors their execution; evaluates the main IT investments foreseen in the IT Master Plan; ensures the adoption of IT governance practices established in current regulations; among other duties.

Contingency Committee: a collegiate body responsible for providing the executive decisions necessary to contain and resolve crises within the scope of business continuity.

Sustainability Committee: promotes the integration of social, environmental, climate, governance and territorial dimensions into BNDES policies, processes, practices and procedures, in line with the Social, Environmental and Climate Responsibility Policy, regional development policies and other socioenvironmental and climate policies.

Image and Reputation Crisis Committee: analyzes and manages the BNDES System’s image and reputation crises.

Budget and Financial Affairs Committee: analyzes issues related to the financial management of the BNDES System; periodically monitors and assesses the indicators and targets for profitability, liquidity, capital, risk and other financial indicators of interest to the BNDES System; evaluates measures with significant potential for financial and capital impact on the BNDES System; ensures consistency between the Operational Policies, the Financial Policy and the Credit Policy, aiming at compliance with the objectives of the Financial Policy of the BNDES System.

Operations Reputational Risk Committee: monitors issues related to reputational risks in non-refundable and sponsorship operations.

Executive Committee on Governance and Monitoring Fapes: guides the unit responsible for the administrative management, supervision and inspection of Fapes, as well as supports the Executive Board in the processes of monitoring and deliberating on topics related to supplementary pension and supplementary health benefits operated by Fapes.

Follow-up Committee of External Inspection, and Control Demands: monitors and follows up on external demands, with a focus on governance of the responses to be prepared.

Management Committee: works to normalize management standards, promotes the strengthening of the relations between our fundamental units, and oversees the implementation of the strategic guidelines defined by the Executive Board, the Strategy Management Committee, and by our corporate plan.

Credit and Operations Committee: discusses and deliberates on operational matters of eligibility and approval of financial collaboration requests, credit risk classification and accreditation of financial institutions.

Risk Management Committee: permanent forum of deliberative and consultative nature to assess and monitor matters related to risk management, internal controls and compliance. It assesses and monitors the management of the following risks, including the execution of the BNDES System Risk Stress Testing Program: a) market risk; b) interest rate risk in the banking portfolio; c) liquidity risk; d) credit risk, including counterparty credit risk and concentration risk; e) operational risk; f) model risk; g) social risk; h) environmental risk; i) climate risk; and j) others. The creation of an integrated risk committee in 2023, after almost five years operating with three committees, aims to increase the efficiency of BNDES's risk management and better integrated risk management, with greater adherence to CMN Resolution No. 4,557/2017.

Project Structuring Committee: discusses, recommends and decides on operational and financial sustainability issues, within the scope of the Government and Institutional Relations, Structuring of Investment Partnerships, and Structuring of Companies and Divestments divisions.

BNDES Information Security Committee: evaluates and monitors matters related to the management of information security, providing relevant information about them to the BNDES’s Administration.

Sponsorship Committee for Direct Choice Modality: issues, at any time, a recommendation to continue or interrupt sponsorship requests that are submitted to it by the Office of the President, with a view to their acceptance in the modality of Direct Selection, and approves, in the first instance, the annual calendar of actions proposed by the Marketing Department.

Information Technology Management Committee: monitors the portfolio of information technology projects and deliberates on changes to it; establishes priority IT issues; and monitors the levels of IT services, proposing improvements whenever necessary.

Financial Affairs Committee: assesses issues related to financial and accounting policies; assesses, monitors and periodically evaluates the global goals, the selected financial indicators and the capital plan; and ensures consistency between the operational, financial and credit policies; among others.

People Management Committee: supports and guides the activities performed by the People Management and Organizational Culture Area, ensuring the adequacy and optimization of people management policies; the internal personnel movement process; and the organizational adequacy processes.

Capital Market Deliberative Committee: regarding variable income securities, deliberates on the preliminary assessment of the eligibility of transaction requests, and regarding instruments for participation in investment funds, among other attributions, deliberates on the proposal to hold a public call for the selection of investment funds in participations and projects and credit funds, prior to their submission for deliberation by the competent decision-making authority.

Contingency Subcommittee: provides the executive decisions necessary to contain and resolve incidents that cause the interruption of BNDES' critical business processes.

The BNDES’s financial statements are prepared in accordance with the regulations of the Central Bank of Brazil (BCB) and the National Monetary Council (CMN), and based on the Corporations Act (Law 6.404/1976), on Law 13.303/2016, of CMN Decree 8.945/2016 and on the norms of the Brazilian Securities and Exchange Commission (CVM) for consolidation purposes, when they are not in conflict with BCB and CMN norms. The statements are presented in accordance with the Accounting Plan of National Financial System Institutions (COSIF).

The BNDES also prepares its Consolidated Financial Statements in accordance with International Accounting Standards – IFRS, as issued by the International Accounting Standards Board (IASB) and with the interpretations of the International Financial Reporting Interpretations Committee (IFRIC).

The systematic recording of the companies in the BNDES System is decentralized. In accordance with Book of Accounting Practices, approved by the BNDES’s Executive Board Resolution 4109/2023 of 11.6.23: “accounting is responsible, among other attributions, for the monitoring of records of decentralized accounting, identifying the responsible parties for each ledger account, and requesting adjustments if necessary”.

As defined by the BNDES’s Basic Internal Organization (OIB), the Accounting Department (DEPCO) is responsible for “planning, coordinating, guiding and, when applicable, performing the bookkeeping of enterprises in the BNDES System”. DEPCO thus acts as the “guardian” of bookkeeping.

We maintain relationships with a variety of audiences, in line with our institutional strategy and the coordinating role we play in promoting the country’s development. Through these interactions, we collect information and insights to improve our service and adjust our strategy whenever necessary. Our relationship policy establishes guidelines for our interactions, indicating the principles that should guide them—trust, ethics, integration, proximity, and transparency—and defining our main stakeholders

The role of development financial institutions (DFI) in effectively promoting economic, social, and environmental development has gained increasing recognition in recent years, and this, in turn, has increased the importance of these institutions in different countries. Agendas are increasingly challenging, and traditional isolated actions of countercyclical action in favor of economic growth are no longer sufficient.

It is essential to consider socioenvironmental and climate commitments, with inclusion and appreciation of diversity, to effectively promote sustainable development.

The resumption of a more impactful operation by the BNDES is necessary in this context. Throughout our history, we have demonstrated that we are a resilient institution, with a strong ability to anticipate and adapt to changes to contribute to the country’s development. This resilience will again be necessary to achieve the objectives outlined in our new corporate strategy.

This resumption comes in response to the retraction of our activities in recent years, which compromised our contribution to the Brazilian economy and put at risk our ability to support the country’s long-term development. The domestic increase in poverty and hunger, the worsening of inequalities, income stagnation, and deindustrialization in recent times were accompanied by other issues that the country shares with the rest of the world, such as the climate emergency, armed conflicts, threats of new pandemics, and the development of new artificial intelligence technologies.

In this context, the BNDES is a fundamental instrument for implementing a development agenda combined with new global needs. In the envisioned scenario of increasing our contributions to the Brazilian economy, it is important to expand and diversify our funding sources, which should contribute to adapting our financing structure to the different missions of a development bank to reduce costs and develop innovative capital market instruments.

A more active BNDES will face major challenges, such as reducing the investment gap in infrastructure while also promoting the energy transition and decarbonization of the economy; expanding the population’s access to public services and increasing the competitiveness of the national production system. Support for environmental and climate projects should also be expanded, including ecological transformation and biodiversity protection. Support for social inclusion and public management projects should reduce inequalities and promote citizenship. Within the scope of promoting decent work and income and expanding access to credit, we should stimulate entrepreneurship, micro-, small-, and medium-sized enterprises (MSMEs), microcredit, and cooperatives, which will involve expanding partnerships with different types of institutions operating in the financial market.

The promotion of productive sectors, in turn, will focus on developing a new industrialization of the economy, making it greener and more innovative, inclusive, digital, and permeated with processes to encourage the circular economy, with a consequent increase in productivity and qualified job creation. Other major challenges are the resumption of our support for exports and the insertion of national companies in the international market to increase competitiveness.

Finally, internally, the institution must accelerate digital transformation—thereby allowing the reduction of operational costs and risks—, simplify processes, and improve its relationships with customers and partners.